The elites driving radical right Republican Party farther into extremism are creative little devils. Truthout reports on one scheme by which the radical right Republicans in control of the House of Representatives can immunize DJT against prosecution. This might actually work. Truthout writes:

Matt Gaetz Has a Plan for Blocking Jack Smith’s Indictments of TrumpGaetz believes a select committee should be established to grant Trump immunity from prosecution for his crimes

Congressman Matt Gaetz (R-Florida), an ardent loyalist to Donald Trump, has suggested a plan to disrupt the dual investigations into the former president led by Department of Justice (DOJ) special counsel Jack Smith.

Unfortunately for Gaetz, however, the plan requires Trump to refrain from lying during his testimony before a House panel in Congress.

Gaetz has presented a number of strategies for how he and other Trump allies could protect the former president as he faces dozens of federal indictment charges. Last week, for example, he suggested that Republicans subpoena Smith to appear before the House Judiciary Committee, noting that if Smith refused to do so, he could be held in criminal contempt of Congress. Last month, he suggested that Congress vote to “defund” the special counsel’s office, limiting additional actions that Smith could take against the former president.

Gaetz explained his latest plan this week while discussing Trump’s most recent indictments, relating to his attempts to overturn the 2020 presidential election, with right-wing radio host Charlie Kirk. In order to end the investigation and other federal charges (from the Mar-a-Lago documents case, or any other future charges), the House of Representatives would have to grant Trump whistleblower protection status, Gaetz said.

Afterward, “you can actually bring President Trump in to give testimony to the Congress and, in doing so, immunize him,” he went on.

Gaetz noted that House rules require a committee to have a “supermajority vote” in order to grant someone “full immunity” — but he had a plan for that as well.

“Speaker McCarthy could set up a select committee tomorrow,” Gaetz said, adding that if the committee was made up mostly of Republican lawmakers, they could achieve a supermajority vote.

The plan, as explained by Gaetz, would require the House to establish a select committee. McCarthy cannot do so on his own — he needs a majority vote in the House, which would require nearly every Republican in the chamber to cooperate with the scheme, given the GOP’s extremely narrow majority. The plan would also likely be challenged in courts by the DOJ, which may argue against the legality of granting Trump immunity in a way that is so transparently corrupt.

Gaetz admitted that the scheme would require Trump to actually testify before the theoretical select committee — and that new problems could arise from him doing so, such as Trump, a well-documented liar, perjuring himself.

Think about that for a minute or two. First, Democrats in the House cannot block this plan -- they need some Republicans to defect. Second, House Republicans could probably vote to change the rule from a supermajority vote to a simple majority, if that was deemed necessary. Third, once DJT is immunized, he could just keep lying or say as little as possible, if he had the discipline to do so -- prosecution for perjury is better than prosecution for treason, etc. (the crimes he is currently being prosecuted for). Fourth, there is no guarantee that if the DoJ did challenge the corrupt radical GOP immunity scheme in court that the corrupt radical Republican US Supreme Court would see it as corrupt.

This one really creeps me out.

__________________________________________________________________

__________________________________________________________________

Early warning - starving the beast: Heads up folks, the USSC (US Supreme Court) has picked up another nuclear weapon to play with. This one could blow government and democracy to smithereens. The Hill writes:

The Supreme Court has agreed to hear one of the most important tax cases in history, which could either greenlight the constitutionality of an economically disastrous wealth tax, or destroy critical parts of the U.S. tax system.Historic Supreme Court case could imperil the entire US tax code

Unless the justices take a middle road and define the 16th Amendment according to the history and traditions of the U.S. tax system, the case will result in bad law and worse outcomes.

The case (Moore v. United States) concerns the constitutionality of the 2017 Tax Cut and Jobs Act (TCJA). The act imposed a mandatory repatriation tax on pre-2018 profits that companies and some U.S. shareholders stored abroad. Previously, foreign business profits went untaxed until they returned to U.S. shareholders. But under mandatory repatriation tax, passed as part of Republicans’ comprehensive international tax reform, profits were taxed even if shareholders never received the income.The court faces a difficult question: Is this mandatory tax on foreign profits that shareholders never actually received constitutional under the 16th Amendment? The Supreme Court has maintained since 1920 that income must be “clearly realized” for it to be taxable. Yet the U.S. tax code is riddled with taxes on unrealized income.

For example, the main tenet of partnership tax law is that partners are taxed on income allocated to them for tax purposes, whether or not they actually receive the income. The Supreme Court upheld this principle in 1938, less than three decades after the 16th Amendment was ratified. Since 1962, the United States has also taxed the passive and highly mobile income of overseas corporations controlled by U.S. shareholders, whether or not the income is distributed to them, to prevent aggressive tax avoidance strategies. The TCJA’s mandatory repatriation tax fits within this existing international tax regime.

Although The Hill describes it as an economically disastrous wealth tax, I'm not sure that is the case. For decades, wealthy people and special interests have been buying people in congress to get them to pass laws that legalize corruption and tax evasion. That legalized corruption campaign has been worth trillions of dollars, not merely hundreds of billions.

By now it is clear that the the radical right Republican judges on the USSC (i) are dominated by a virulent, enraged hate of secular, transparent (honest) government, and (ii) they have abandoned precedent and intellectual principle to get what their ideologies demand in their court decisions. In view of that, they just might mostly obliterate the government's ability to collect taxes. That result would be completely in accord with the radical right's decades-long strategy called Starve the Beast.

One source commented about the decades-long Starve the Beast government killer movement:

Republicans still trying to starve the beastThe GOP, which didn’t have much trouble supporting deep tax cuts during the presidency of Donald Trump, is now worried about the federal deficit. Republicans’ answer, once again, is to cut domestic spending.

After that, they’ll propose more tax cuts, which will make the federal deficit and debt even larger, which will require — you guessed it — further cuts in domestic spending.

Republicans never look for additional revenue. And they really don’t care how tax cuts will impact the overall economy. The Trump tax cuts were enacted during a period of solid economic growth, not during a recession, when additional government spending can be necessary to jump-start the economy.

No, the GOP is always looking for opportunities to cut spending because cutting spending means shrinking government, which is really the goal of many Republicans in the first place. It’s the “starve the beast” strategy that conservatives have long pursued.**

The original meaning in Black Law’s dictionary from 1910 claims that income must be “received” to be defined as such, and that any income that has not been received cannot be taxed. As much as the justices want to preserve longstanding principles of the U.S. tax system, they cannot do it without setting precedent against the original meaning of “income” and authorizing a wealth tax.

__________________________________________________________________

__________________________________________________________________

A strange but powerful absenteeism phenomenon has struck American public schools. Millions of students are simply not showing up for school. The Ap writes:

SPRINGFIELD, Mass. – When in-person school resumed after pandemic closures, Rousmery Negrón and her 11-year-old son both noticed a change: School seemed less welcoming.

Parents were no longer allowed in the building without appointments, she said, and punishments were more severe. Everyone seemed less tolerant, more angry. Negrón's son told her he overheard a teacher mocking his learning disabilities, calling him an ugly name

Her son didn’t want to go to school anymore. And she didn’t feel he was safe there.

He would end up missing more than five months of sixth grade.

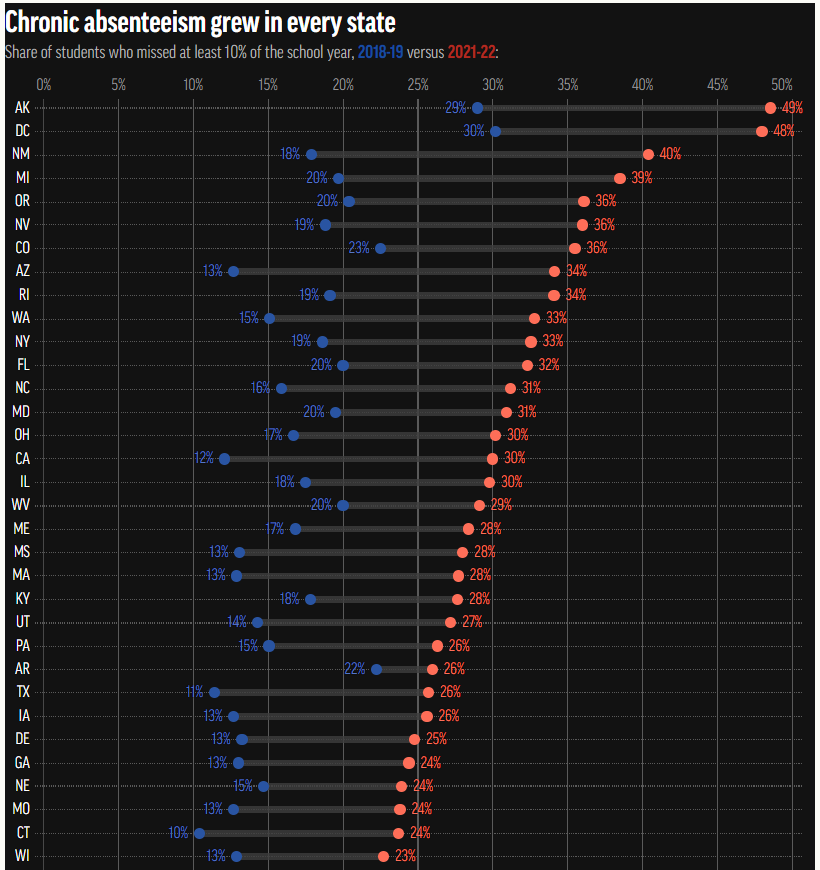

Across the country, students have been absent at record rates since schools reopened during the pandemic. More than a quarter of students missed at least 10% of the 2021-22 school year, making them chronically absent, according to the most recent data available. Before the pandemic, only 15% of students missed that much school.

All told, an estimated 6.5 million additional students became chronically absent, according to the data, which was compiled by Stanford University education professor Thomas Dee in partnership with The Associated Press. .... Absences were more prevalent among Latino, Black and low-income students, according to Dee’s analysis.CA = 30.0% chronically absentOH = 30.2%, FL = 32.3%, Al = 17.9%, MA = 27.7%, AK = 48.6%

Kids are staying home for myriad reasons — finances, housing instability, illness, transportation issues, school staffing shortages, anxiety, depression, bullying and generally feeling unwelcome at school.

It looks like the bigotry, rot and vulgarity of intentionally divisive, rancid US politics is spilling over into the rest of American society. My analysis:

1. Rancid US politics, including attacks on public education and teachers, has spilled over and is one part of the cause, ~40% responsible

2. To the extent politics is relevant, the radical right and its propagandists (Faux News, the GOP, etc.), supporters and enablers = ~80% responsible

Everyone and everything else = ~20% responsible

No comments:

Post a Comment