Meidas Touch News reports that DJT apparently did it again in an incoherent political rally speech:

Donald Trump once again defamed his rape victim, E. Jean Carroll, this time during a rally in Rome, Georgia on Saturday. .... During the dark, rambling and often incoherent speech, Trump complained that “sometimes it’s not good to be rich” before adding:

“I just posted a $91 million bond – 91 million – on a fake story, totally made up story. Think of it – 91 million! I could say things about what it would cost normally. $91 million! Based on false accusations made about me by a woman I know nothing about, didn’t know, never heard of. I know nothing about her. She wrote a book. She said things. And when I denied it, I said, ‘It’s so crazy. It’s false.’ I got sued for defamation.”

Trump then called Carroll “not a believable person” and called Judge Kaplan a “highly corrupt judge.”

That speaks for itself.

__________________________________________________________________

__________________________________________________________________

Senator Sheldon Whitehouse (D-RI) wrote a 57 page legal analysis criticizing the USSC. The paper, Knights-Errant: The Roberts Court and Erroneous Fact-Finding, argues that not only is the USSC not supposed to do fact finding, which is correct because that is the job of the trial court and discovery. And, when it does its own fact finding, it often gets facts wrong. In essence, Whitehouse argues that the TTKP justices are political hacks who make facts up when the actual facts in the record before the court are inconvenient. Here is how Whitehouse argues his case:

The Supreme Court has broken long-standing rules and practices to force desired results on the American people. One such violation has been its excursion into fact-finding, based not on the record before it, nor on factual findings of Congress, but on imagined or confected findings that served ulterior purposes of the justices. The Court’s persistent refusal to confront these errors in the face of overwhelming evidence only makes the Court’s conduct more egregious. The Court’s new emphasis on “history and tradition” threatens even more wanton and arbitrary fact-finding, and Bremerton foreshadows deliberate disregard by justices of even adjudicatory facts plain in the record before them.The Supreme Court’s claim to supremacy in constitutional interpretation is at its weakest when the interpretation is premised on bogus facts. Even the power to “say what the law is” enjoys no textual support in the Constitution. Asserting that the Court has ultimate authority to say what the facts are leaps into constitutional fantasy, and endangers the balance between the Supreme Court and its coequal branches. The Court has no special competency to find facts. When fact-finding is done in an unconstrained manner, when the facts arrived at are indefensible, and when they are used to reach a preferred outcome, this signals wrongful trespass into the policymaking function the Constitution assigns to the political branches.

The American people deserve a Court that plays by the rules. If the Court continues to play fast and loose with the facts to suit the outcome its Republican supermajority wants, Congress has tools to remedy the abuse. Something needs to be done. That something should start in the halls of Congress, and it should start now.

In my opinion, Whitehouse is correct is his analysis and criticisms. But his proposed solution falls flat. Congress is not going to remedy anything. That is out of the question for the foreseeable future.

Whitehouse singles out a few prominent cases where the USSC went rogue, at great cost to democracy, the rule of law and literally human lives. Those cases include Shelby County (gun safety law), Citizens United (corporations are humans and campaign finance laws invalid), Dobbs (got rid of the right to an abortion), Bruen (gun safety law), and Bremerton (Establishment Clause law decision that blew a big hole in church-state separation, giving expanded access of already tax subsidized churches to tax revenues -- churches can force states to fund their operations).

Our USSC is not only radicalized authoritarian, it is profoundly corrupt. It is morally and intellectually unprincipled to the point of having gone full-blown rogue. Autocratic, Christian and plutocratic dictatorship in America might not even need DJT to do the job. The USSC has to power to do it all by itself and is doing it all by itself.

__________________________________________________________________

__________________________________________________________________

A MSNBC opinion comments on how Mike Johnson dealt with the Biden State of the Union address:

Mike Johnson’s eye rolls are a reminder of what Biden is really running against this fall

Republican control of the House of Representatives is a sickness that ought to be excised from the body politicWe can now count “keeping a poker face” among the skills Speaker of the House Mike Johnson is notably lacking, alongside “vote counting” and “swaying his own caucus.” .... Johnson’s eye-rolling and head-shaking turned him into an instant meme across social media, his barely contained discontent providing some comic relief at an otherwise somber moment.

__________________________________________________________________

__________________________________________________________________

The NYT reports about self-interested abuse of charity donation law by the cheapskate fascist Elon Musk:

Elon Musk Has a Giant Charity. Its Money Stays Close to Home.

After making billions in tax-deductible donations to his philanthropy, the owner of Tesla and SpaceX gave away far less than required in some years — and what he did give often supported his own interestsBefore March 2021, Elon Musk’s charitable foundation had never announced any donations to Cameron County, an impoverished region at the southern tip of Texas that is home to his SpaceX launch site and local officials who help regulate it.

Then, at 8:05 one morning that month, a SpaceX rocket blew up, showering the area with a rain of twisted metal.The Musk Foundation began giving at 9:27 a.m. local time.

Musk runs a charity with billions of dollars, the kind of resources that could make a global impact. But unlike Bill Gates, who has deployed his fortune in an effort to improve health care across Africa, or Walmart’s Walton family, which has spurred change in the American education system, Mr. Musk’s philanthropy has been haphazard and largely self-serving — making him eligible for enormous tax breaks and helping his businesses.

This is how one money manager (a behemoth called Fidelity Charitable) talks about charitable donations by rich folk:

Income tax strategies — Donations to 501(c)(3) public charities qualify for an itemized deduction from income. Because the tax rate is then applied to a reduced income, this can minimize your overall tax liability. Many donors don’t realize that there are many ways to maximize this seemingly straightforward deduction. For instance, you can “bunch” your charitable contributions in a single tax year, using a donor-advised fund, to increase the amount you donate in a high-income year, and then the funds can be used to support charities over time. Or you can make a combined gift of appreciated assets and cash to maximize your benefits.

Capital gains tax strategies — You can use charitable contributions to reduce your capital gains tax liability by donating long-term appreciated assets. Not only can you deduct the fair market value of what you give from your income taxes, you can also minimize capital gains tax of up to 20 percent.

Estate tax strategies — The federal estate tax is a tax on the transfer of your property at your death. In 2024 the estate and gift tax exemption is $13.61M per individual, so fewer estates will be subject to this tax. By making properly structured gifts and donations, you can remove assets from your estate before the total is tallied and taxed. In fact, you have an unlimited charitable deduction if your estate plan makes gifts to charities.

One has to wonder, what is the net cost-benefit to democracy and society of charitable giving? For rich people, it benefits themselves, especially if they set up their own charity and keep control of the donations like Musk does. This question has been raised before, e.g., like in this 2018 research paper:

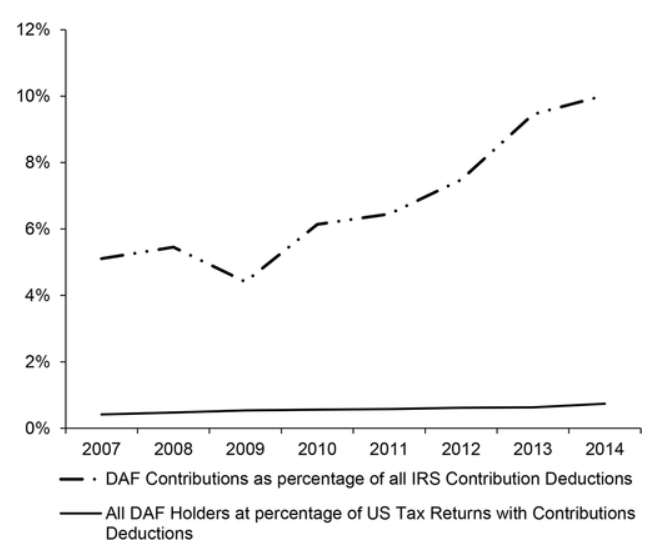

Donor Advised Funds (DAFs) are now a major source of charitable do nations in the United States, responsible for 1 in 10 dollars donated to charity in 2015. In 2016, Fidelity Charitable, whose only mission is to provide DAFs, became the largest charity in the United States. Paradoxically, most people have never heard of DAFs or Fidelity Charitable. This leads us to ask, who uses DAFs and why, what is the impact of government tax policy toward DAFs, and could the extra fiscal cost of subsidizing DAFs be balanced out by an extra public gain of new charity resulting from tax policy toward DAFs?Do DAFs involve enough money for policymakers to really worry about? Perhaps surprisingly, the answer is a resounding yes. Figure 1 illustrates recent trends in DAFs. From 2007 to 2015, contributions to DAFs rose by 240% to a total of $22.26 billion per year. Grants from DAFs to charities rose by a similar percent, to $14.5 billion. Year-end assets—the unspent contributions—climbed to $78.64 billion, a 255% increase. Over the same period, the number of DAF accounts grew as well, but at a relatively slower pace of 178% to almost 270,000 accounts.

No comments:

Post a Comment