America has two parties that hold power in Washington. One, the Democratic Party, is fiscally responsible and conservative, while the other is mostly fiscally irresponsible and spendthrift. For example, the opposite party passed a tax cut for rich people and corporations law in December of 2017 and that fiscally irresponsible beast is projected to add about $0.9 trillion to federal debt each year, with ~75% of the benefits flowing to the top ~20% of earners and foreigners. Most everyone else got a small to tiny tax cut. A few households, like mine, experienced a tax hike, running at about $9,000 this year. Big corporations also saw significant tax cut benefits.

To be clear, opposite party policy reflects its decades-ling strategy known as

Starve the Beast. The starvation strategy is to limit government, something the Republican Party hates with a vengeance and constantly lies about. Accompanying the Starve the Beast strategy as a "rationale" is economic crackpottery called things like supply side economics, trickle down economics or, my favorite, horse and sparrow economics. The horse and sparrow theory holds that if you feed the horse enough oats, some will pass through and some stuff will fall on the ground, which the sparrows can pick through and find a few oats to eat. I suppose one could also call that the pass-through economic theory. Trickle down or whatever one wants to call it, works like about this in practice:

At present, the Democratic Party is trying to find ways to pay for the second infrastructure bill called Build Back Better (BBB). Not surprisingly, Republicans hate it with a vengeance because it involves government spending money for things other than rich people and big corporations. The situation looks not so good for finding ways to pay for BBB.

The New York Times reports:

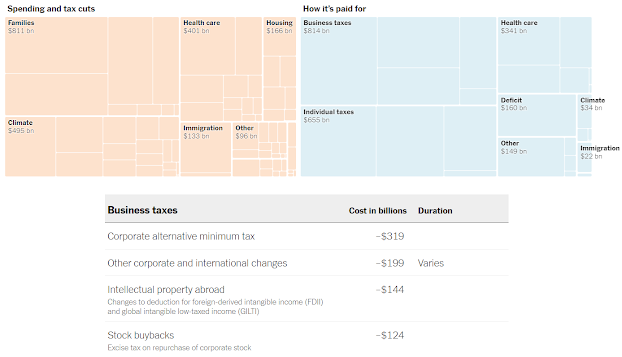

The nonpartisan Congressional Budget Office said on Thursday that President Biden’s sprawling climate change and social policy package would increase the federal budget deficit by $160 billion over the next 10 years.

That determination was at odds with Mr. Biden’s pledge to fully pay for the $1.85 trillion legislation but was unlikely to stop House Democrats from approving the bill.

Plans to do so Thursday evening, however, were derailed when a marathon speech by Representative Kevin McCarthy of California, the minority leader, prompted Democratic leaders to send members home with plans to reconvene at 8 a.m. on Friday.

The budget office’s analysis found that the bill’s tax cuts and spending programs were almost — but not entirely — offset by new revenue and spending cuts. The package would be largely paid for with tax increases on high earners and corporations, which were estimated to bring in nearly $1.5 trillion over 10 years. Savings in government spending on prescription drugs were estimated to bring in another $260 billion.

The NYT goes on to report that House Democrats are disputing the CBO about how much the Internal Revenue Service would collect by cracking down on people and companies that cheat on their taxes. The difference between what is owed and paid is the tax gap. It is running at about $1.2 trillion/year at present. In my opinion, that's a lot of tax cheating. The CBO rejects the White House assertion that the IRS would collect about $207 billion from tax cheats over ten years.

Say what??

Think about that a moment. Over 10 years, tax cheats will make off with about $12 trillion in unpaid taxes if the tax gap stays the same as it is now. And Democrats, in the face of Republican opposition to going after tax cheats have to struggle to just claw back a piddly ~$207 billion in the name of Starve the Beast ideology. For context, ~$207 billion amounts to 1.72% of $12 trillion.

Starve the Beast dogma is so powerful that it demands that tax cheats be protected in service to starving the government to death. And what would the evil Democrats and government do with the tax cheat money if only there was some way to get it?

Horrible, horrible things like imposing environmental protection regulations, expanding health care, controlling drug prices, and adding education and child care support. Those things are so horrible that

some polling indicates most Americans support it.[1] Presumably, the Republican Party hates BBB because it feeds the beast and shows that government can actually do some good and non-trivial things for average people.

Questions:

1. Is it too much of a burden or otherwise bad to try to recover some revenue lost to tax cheats to pay for a part BBB spending?

2. Should the beast be starved as the Republican Party wants and domestic spending programs like social security, Medicare, food stamps and the like be eliminated?

3. Which party, Democratic or Republican, is more fiscally responsible and conservative?

4. Is trickle down or horse and sparrow a better label for the supply side economic theory the Republicans rely heavily on?

Footnote:

1. Yes, this is a puzzle. Congressional Republicans paint BBB as socialist or communist tyranny, fiscal irresponsibility, the end of civilization as we know it, against God's will, deep state subversion and pedophilia, and/or whatever else they can think to smear and attack it with. Why most average people might support it is a real head scratcher. (sarcasm)