From the Incredible Things Files:

George Santos caves in to revelations of truth

Ending a weeklong silence, Representative-elect George Santos admitted on Monday to a sizable list of falsehoods about his professional background, educational history and property ownership. But he said he was determined to take the oath of office on Jan. 3 and join the House majority.

Mr. Santos, a New York Republican who was elected in November to represent parts of northern Long Island and northeast Queens, confirmed some of the key findings of a New York Times investigation into his background, but sought to minimize the misrepresentations.

“My sins here are embellishing my résumé,” Mr. Santos told The New York Post in one of several interviews he gave on Monday.

Mr. Santos admitted to lying about graduating from college and making misleading claims that he worked for Citigroup or Goldman Sachs. He once said he had a family-owned real estate portfolio of 13 properties; on Monday, he admitted he was not a landlord.

Mr. Santos, the first openly gay Republican to win a House seat as a non-incumbent, also acknowledged owing thousands in unpaid rent and a yearslong marriage he had never disclosed.

“I dated women in the past. I married a woman. It’s personal stuff,” he said to The Post, adding that he was “OK with my sexuality. People change.”

Mr. Santos also firmly denied committing a crime anywhere in the world, even though The Times had uncovered Brazilian court records showing that Mr. Santos had been charged with fraud as a young man after he was caught writing checks with a stolen checkbook.

“I am not a criminal here — not here or in Brazil or any jurisdiction in the world,” he told The Post. “Absolutely not. That didn’t happen.”

“I never claimed to be Jewish,” Mr. Santos told The Post. “I am Catholic. Because I learned my maternal family had a Jewish background I said I was ‘Jew-ish.’”

So, it is OK to take the oath of office because all that poor, persecuted Santos did was embellishing his résumé and just doing personal stuff. You know, personal stuff sort of like what Bill Clinton did while on office and got impeached for. And, he is Jew-ish, not Jewish.

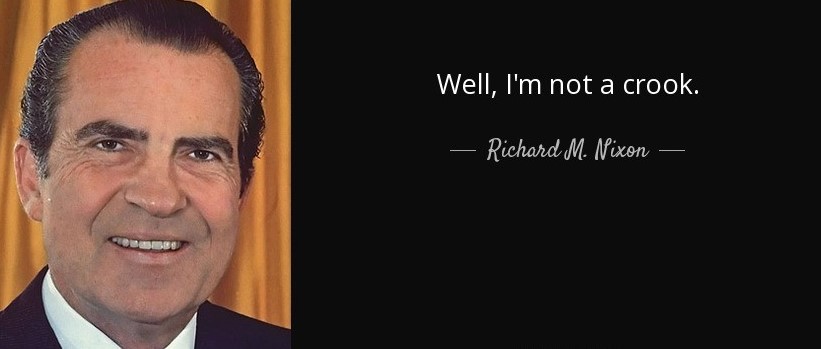

For some context on the morality of what merely embellishing a résumé and other lies amount to:

For some context on how bad deceit by politicians can be:

Q: Is it reasonable to argue that when a politician deceives people and they act, e.g., vote, on the basis of that deceit that the politician has taken away the power of people to make decisions on the basis of facts, truths and/or sound reasoning?

Jeez, that was a juicy one for sure.

Some welcome common sense about guns

Recent mass shootings have spurred renewed calls from President Biden for a national assault weapons ban. Sensibly so. But for even the most ardent gun control advocates, it’s hard not to ask whether, in a nation with an estimated 400 million firearms, restrictions on new gun purchases accomplish too little without something more.

Amid the rising tide of firearms, reducing gun deaths and injuries requires new solutions. In San Jose, Calif., where I am mayor, we’ve embarked on two approaches untried in any other city or state: We’re imposing an annual fee on gun-owning residents and investing the revenues in violence prevention efforts. And on Jan. 1, the city will begin requiring gun owners to carry liability insurance to compensate victims harmed by the negligent or reckless use of a firearm.

In San Jose, the nation’s 10th-largest city, more than 200 people are killed or injured by gunfire every year. Not all of that harm results from the actions of criminals. Over a recent six-year period, 42 percent of San Jose’s gun deaths and injuries resulted from unintentional shootings or shootings whose circumstances were unknown, while suicide attempts accounted for another 15 percent. Suicide exacts an even more lethal toll nationally, accounting for 54 percent of gun fatalities. So much of that suffering is preventable.

Many studies have shown that the mere presence of a gun in a home makes a host of perilous circumstances much more lethal. A domestic violence victim faces five times the risk of being killed if the abuser has access to a gun, for example, and the odds of suicide in a home with access to a firearm are more than three times that in other homes.

.... beginning next year, San Jose will require gun owners to pay an annual fee — the amount is still to be determined — which a nonprofit foundation will invest in evidence-based violence prevention programs directed at gun-owning families. This policy won’t magically halt mass shootings or suicides, but it will provide a better chance to get help to troubled adults and teenagers before they pick up their guns.

Of course, in the realm of gun regulation, no good deed goes unlitigated. Three groups sued San Jose after the ordinance imposing the fee and insurance requirement passed. A Federal District Court declined their pleas for an injunction to stop the ordinance from taking effect, finding no unconstitutional burden on Second Amendment rights when “there are no means by which a San Jose gun owner may be deprived of his or her firearm.”

Finally, someone has caught on to the idea of making gun owners pay for at least some of the social and economic damage their guns inflict. This is decades overdue. But better late than never.

The scumbag and his tax cheating

A DC Report (left bias, high fact accuracy) by tax expert David Cay Johnston has checked out his tax returns:

Trump’s Brazen Tax Cheating RevealedTrump Took Tax Losses He Knew Were Fraudulent

Donald Trump knowingly committed dozens of brazen tax frauds during the six years when he ran for office and was President, my analysis of the Congressional report on his tax returns and other documents shows. This explains why he fought all the way to the Supreme Court in a failed effort to keep his tax information secret.

One technique he used at least 26 times between 2015 and 2020 was as simple as it was flagrant. Trump filed sole proprietor reports, known as Schedule C, that showed huge business expenses despite having zero revenue. That created losses which Trump used to offset his income from work and investments, thus lowering his income taxes. Additional Schedule Cs had expenses exactly equal to revenues while only a few showed profits.What Trump did again and again and again—taking expenses for businesses with no revenue—is so simple that jurors should have no trouble understanding the issues were Trump to be indicted by a federal or New York state grand jury.

Trump knew this was unlawful because he lost two trials over his 1984 income taxes in which he did the exact same thing, a story I broke in June 2016. Both judges, in scathing opinions, ruled that Trump committed civil tax fraud.

That Trump persisted in using the same fraudulent technique in six years of recent tax returns is powerful evidence of mens rea or criminal intent. This device is not Trump’s most lucrative tax cheating technique, but it is the easiest for jurors to understand should Trump be indicted on tax charges.

It may shock you to learn that there are legal ways to turn the burden of income taxes into a source of profit. Still, every sophisticated tax accountant and lawyer knows how business owners, especially real estate operators like Trump, can do this legally. As a leading Manhattan tax lawyer told me years ago: “If you’re big in real estate and pay any income tax, you should sue your tax lawyer for malpractice.”

Workers and pensioners are excluded from the rules that let rich business people and landlords convert the burden of income taxes into the joy of financial gains.

Nah, not possible!