A core goal of the Christian nationalist political movement is to aggressively protect and expand tax breaks for its growing scope of allegedly religious activities. Rapacious Christian gold diggers are claiming religious freedom for more and more activities. Those activities are qualifying for IRS tax status and direct payment from governments or indirect tax subsidies. The Supreme Court significantly expanded the reach of religion into state revenue streams in its recent decision requiring states to support religious schools (Supreme Court Rejects Maine’s Ban on Aid to Religious Schools -- The decision was the latest in a series of rulings forbidding the exclusion of religious institutions from government programs).

Apparently, radical right Republican political groups are waking up to the idea of going from non-profit groups with some tax breaks to religious organizations with much better tax breaks. Key reasons to convert from a "charity" to a "religion" are (1) more tax breaks, and more importantly (2) protection from mandatory divulging of financial information. Unlike charities, religious organizations do not have to make their finances public. Fascist Republicans want to do their dirty work in private.

The Family Research Council’s multimillion-dollar headquarters sit on G Street in Washington, D.C., just steps from the U.S. Capitol and the White House, a spot ideally situated for its work as a right-wing policy think tank and political pressure group.

From its perch at the heart of the nation’s capital, the FRC has pushed for legislation banning gender-affirming surgery; filed amicus briefs supporting the overturning of Roe v. Wade; and advocated for religious exemptions to civil rights laws. Its longtime head, a former state lawmaker and ordained minister named Tony Perkins, claims credit for pushing the Republican platform rightward over the past two decades.What is the FRC? Its website sums up the answer to this question in 63 words: “A nonprofit research and educational organization dedicated to articulating and advancing a family-centered philosophy of public life. In addition to providing policy research and analysis for the legislative, executive, and judicial branches of the federal government, FRC seeks to inform the news media, the academic community, business leaders, and the general public about family issues that affect the nation from a biblical worldview.”

In the eyes of the Internal Revenue Service, though, it is also a church, with Perkins as its religious leader.

According to documents obtained via the Freedom of Information Act and given to ProPublica, the FRC filed an application to change its status to an “association of churches,” a designation commonly used by groups with member churches like the Southern Baptist Convention, in March 2020. The agency approved the change a few months later.

The FRC is one of a growing list of activist groups to seek church status, a designation that comes with the ability for an organization to shield itself from financial scrutiny. Once the IRS blessed it as an association of churches, the FRC was no longer required to file a public tax return, known as a Form 990, revealing key staffer salaries, the names of board members and related organizations, large payments to independent contractors and grants the organization has made. Unlike with other charities, IRS investigators can’t initiate an audit on a church unless a high-level Treasury Department official has approved the investigation.

[Not surprisingly,] the FRC declined to make officials available for an interview or answer any questions for this story. Its former parent organization, Focus on the Family, changed its designation to become a church in 2016. In a statement, the organization said it made the switch largely out of concern for donor privacy, noting that many groups like it have made the same change. Many of them claim they operated in practice as churches or associations of churches all along.Warren Cole Smith, president of the Christian transparency watchdog MinistryWatch, said he believes groups like these are seeking church status with the IRS for the protections it confers.

“I don’t believe that a lot of the organizations that have filed for the church exemption are in fact churches,” he said. “And I don’t think that they think that they are in fact churches.”Unlike the Southern Baptist Convention, whose website hosts a directory of more than 50,000 affiliated churches, the FRC’s site does not list these partners or mention the word “church” anywhere on its home page. The FRC’s application to become an association of churches didn’t include this list of partner churches, nor did it provide the names to ProPublica.

The organization’s claim to be an association of churches is disingenuous, said Frederick Clarkson, who researches the Christian right at nonpartisan social justice think tank Political Research Associates.

“The FRC can say whatever bullshit things they want to,” he said. “The IRS should recognize it as a bad argument.”

Three experts told ProPublica that the IRS is failing to use its full powers to determine who gets the special privileges afforded to churches. And when a group like the FRC appears to push the limits of what charities are allowed to do — particularly relating to their partisan political activity — the IRS doesn’t often step in to crack down. [Not surprisingly,] the IRS did not answer a list of detailed questions for this story or make anyone available for an interview.The American Family Association, a Tupelo, Mississippi-based group that runs the influential American Family Radio network, as well as a film studio and magazine, changed its designation to a church in early 2022, according to IRS data. The association sends out frequent “action alerts” to subscribers asking them to sign petitions opposing government appointees or boycott media and brands that it has identified as supporting LGBTQ rights or abortion access. [Not surprisingly], the organization declined to respond to a request for comment.

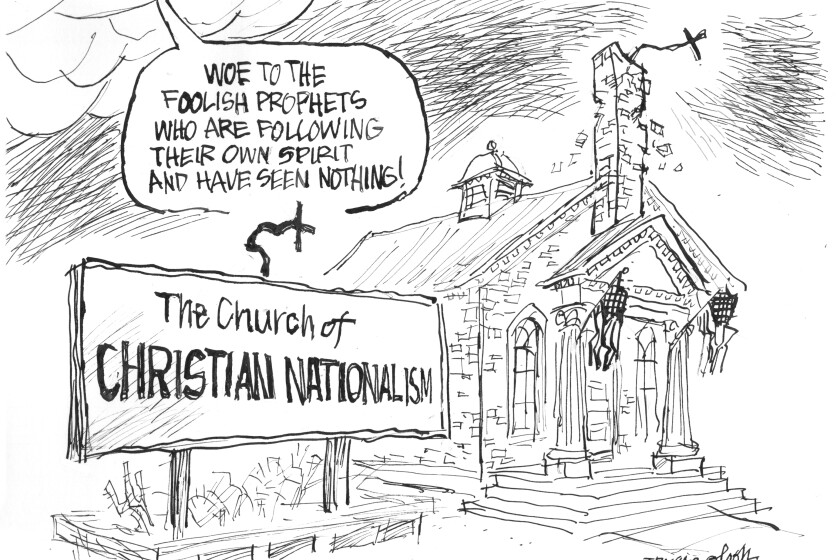

It is really important to understand that the fascist Republican assault on democracy, secularism and civil liberties is well-funded, aggressive, multi-pronged and increasingly successful. Both Christian nationalists and laissez-faire capitalists are exploiting every angle of attack they can exploit. In essence, in addition to controlling society, they want to gain full control of the federal government, all sources of tax revenues and more tax subsidies.

In other words, Republican fascists are hell-bent on using our tax dollars and subsidies against us to take away our democracy and civil liberties. After decades of focused effort, the radical right is starting to succeed on a massive scale. We are in urgent, grave danger.

No comments:

Post a Comment